Fundamentals are associated with the economic health of a company, measured in terms of revenues, earnings, assets, liabilities, Return on Equity (ROE), Return on Assets (ROA), Return on Investments (ROI), growth prospects and cash flows, etc. The fundamentals tell you about a company. You can say a company is having robust fundamentals if it is growing at a nice pace, generating a profit, has limited debts and abundant cash.

The analysis of a company's fundamentals involves getting deep into its financials, rather than day-to-day movement in its share price. Equity researchers normally do fundamental analysis in order to calculate the intrinsic value of a company¡es stock. If a company¡es stock is trading above the intrinsic value or fair value, then the stock is overvalued. If a company¡¯s stock is trading below the intrinsic value, then the stock is undervalued.

However, if you watch the stock markets very closely, the share price of most companies never matches the fair value. Often, day traders and investors who would prefer short term investment options invest in those stocks, regardless of the companies long term growth prospects. However, long term investors generally prefer to invest in companies with robust fundamentals and ignore near-term share price movements.

The following are various components that constitute a company's fundamentals:

Revenues: Revenues (sales) are the total amount of money received by a company through the sales of its goods and services during a specific period of time. Revenues are one of the most important barometers of the growth of a company as it indicates whether there is demand for their products and services.

Cash flows: Cash flows are calculated by deducting a company¡es cash payments from cash receipts over a particular period of time. Cash flows indicate the liquidity position of a company. However, one must pay particular attention to the operating cash flows, since the health of the business can be most clearly seen there.

Balance Sheet: Balance sheet is the company¡es financial statement, which reflects its assets and liabilities. A company¡es fundamentals are said to be robust if its assets are significantly higher than the liabilities. However, one must carefully analyze companies who are reporting large intangible assets as they may have questionable liquidation value to offset any real liabilities.

Return on Assets (ROA): ROA is an Indicator of a company¡es profitability, which is calculated by dividing the net income for the past 12 months by total average assets of the company. This is one of the important indicators, which long-term investors consider before investing into a particular stock.

Although long-term investors and institutional investors consider a company's fundamentals before investing, the share price of a company often does not correspond to the fundamentals ¨C which can present enormous investment opportunities. A company s long-term growth is driven primarily by fundamentals, while a company's share price can be driven by short-term news and investor sentiment, which can be extremely volatile. Every investor must consider a company¡es fundamentals before investing into its stock if you want to gain stable returns over the long term.

This article By Joel Arberman

Sunday, February 15, 2009

Fundamental Forex Trading Analysis

Online Forex Strategies

Forex trading strategies are the key to successful forex trading or online currency trading. A knowledge of these forex trading strategies can mean the difference between a profit and a loss and it is therefore imperative that you fully understand the strategies used in forex trading.

Forex trading is very different from trading in stocks and using forex trading strategies will give you more advantages and help you realize even greater profits in the short term. There are a wide range of forex trading strategies available to investors and one of the most useful of these forex trading strategies is a strategy known as leverage.

This forex trading strategy is designed to allow online currency traders to avail of more funds than are deposited and by using this forex trading strategy you can maximize the forex trading benefits. Using this strategy you can actually utilize as much as 100 times the amount in your deposit account against any forex trade which will make backing higher yielding transactions even easier and therefore allowing better results in your forex trading

The leverage forex trading strategy is used on a regular basis and allows investors to take advantage of short term fluctuations in the forex market.

Another commonly used forex trading strategy is known as the stop loss order. This forex trading strategy is used to protect investors and it creates a predetermined point at which the investor will not trade. Using this forex trading strategy allows investors to minimize losses. This strategy can however, backfire and the investor can run the risk of stopping their forex trading which could actually go higher and it really is up to the individual trader to choose whether or not to use this forex trading strategy.

An automatic entry order is another of the forex trading strategies that is commonly used and this strategy is used to allow investors to enter into forex trading when the price is right for them. The price is predetermined and once reached the investor will automatically enter into the trading.

All these forex trading strategies are designed to help investors get the most from their forex trading and help to minimize their losses. As mentioned earlier knowledge of these forex trading strategies is vital if you wish to be successful in forex trading.

This article from http://www.forexarticlecollection.com

Forex Jpy / Gbp

Every morning on the European open at 0700, the GBP starts to rise against the JPY. On the London open it takes off again, slowly climbing to the New York open at 1300, where anything can happen.

Almost every day we have either straddled 30 pips each way at 0800 or just taken a long trade with a 30-pip stop loss - then follow the price upwards, moving my stop loss in 15-pips behind until I lose my nerve and take the profit!

Spread betting at 50p a point in this way I have been raking the cash in. At the start I turned £27 into £146 in two trading sessions. I know this defies all our sensible money management rules but in the last month I have only suffered three big losses.

Indicators? none - too complicated. I just see how the market has been running, keep an eye on upcoming news (avoid NFP, etc) and wait!

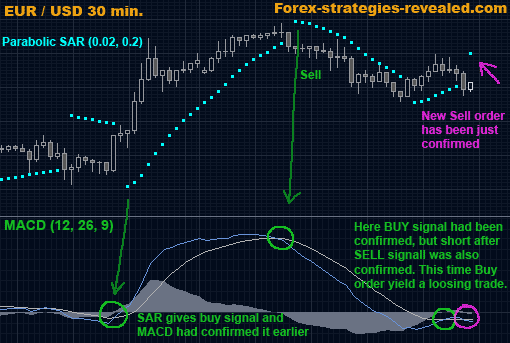

The only useful indicator I use is the parabolic SAR which gives me a good idea when to exit.

It's also a very good idea to study the overall economy, not just the pair you are trading in and learn how prices react to certain events in different parts of the world.

OK this is working NOW, but markets do change so watch out for the bubble burst!

---- by; Paul ------

Labels: Forex Jpy / Gbp

Forex Scalping Techniques

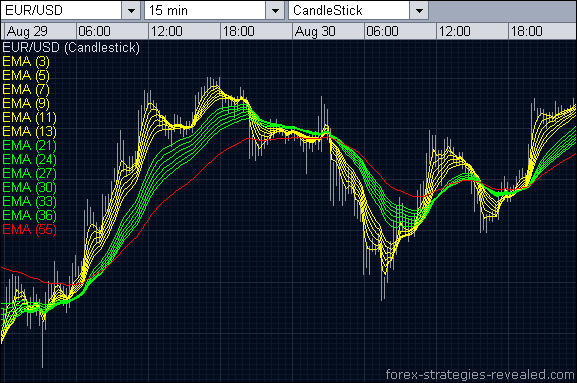

Currency: ANY

Time frame: 1 hour + 30 min + 5 min.

Indicators: 14 EMA, 21 EMA, 50 EMA, Bollinger Band (20, 2).

Entry rules: Enter on 5 minutes chart.

On 5 minutes chart, for uptrend:

if 14 EMA is above 21 EMA,

then if both 14 EMA and 21 EMA are above 50 EMA,

then if 50 EMA is within the Bollinger Bands borders,

then...

go and check 30 min chart:

if price bar is a up-close bar and sitting on 14 EMA or 21 EMA

and same again:

if 14 EMA is above 21 EMA,

then if both 14 EMA and 21 EMA are above 50 EMA,

then if 50 EMA is within the Bollinger Bands borders,

then...

go Long...

OR go and check if 1 hour chart meet same conditions as for 30 min chart and then go Long.

If at least one condition is violated – stay away.

The reverse is for the downtrend:

Enter on 5 minutes chart.

On 5 minutes chart, for downtrend:

if 14 EMA is below 21 EMA,

then if both 14 EMA and 21 EMA are below 50 EMA,

then if 50 EMA is within the Bollinger Bands borders,

then...

go and check 30 min chart:

if price bar is a down-close bar and touching 14 EMA or 21 EMA

and same again:

if 14 EMA is below 21 EMA,

then if both 14 EMA and 21 EMA are below 50 EMA,

then if 50 EMA is within the Bollinger Bands borders,

then...

go Short... or go and check same rules for 1 hour chart and only then enter Short on 5 minutes chart.

Exit rules: exit when any of the conditions is violated or when the profit is high enough to close the trade.

--- by; Edward revy -------

Labels: Forex Scalping Techniques

Free Forex Signals

Free Forex Signal at 12 January 2009

All Pair – Stop loss 35 Pips

EUR/USD

Pivot : 1.3548

Avg. Daily Range : 327 point

BUY at 1.3475 Exit Target 15 pips

SELL at 1.3372 Exit Target 20 pips

GBP/USD

Pivot : 1.5209

Avg.Daily range : 322 point

BUY at 1.5159 Exit Target 20 pips

SELL at 1.5038 Exit Target 20 pips

Note : GBP/USD Stop Loss 40 pips

USD/JPY

Pivot : 90.83

Avg.Daily range :154 point

BUY at 90.13 Exit Target 15 pips

SELL at 89.95Exit Target 20 pips

AUD/USD

Pivot : 0.7048

Avg.Daily range : 141 Point

BUY at 0.7002 Exit Target 15 pips

SELL at 0.6959 Exit Target 20 pips

Labels: Free Forex Signals

Complimentary eBook: Download the full 60-page Deflation Survival eBook now

Part 2 of Elliott Wave International’s expansive NEW Deflation Survival eBook is online now. The free 60-page eBook is packed with Robert Prechter's most important teachings and warnings about deflation. This is one of the most valuable resources EWI has ever offered at no cost. Learn more below or download it now – for free.

……………

Greetings,

We contacted you earlier this week to tell you about an exciting, free 60-page eBook our friends at Elliott Wave International have just put together.

The new eBook is compiled from Bob Prechter’s most important teachings and warnings about deflation.

Much like Prechter’s wildly popular Independent Investor eBook, this new Deflation Survival eBook will transform the way you think – about inflation and deflation.

Most financial experts were caught completely of guard by the real estate top in 2005. Many thought the Dow Industrials index would sour well beyond its 14,000 peak. Others saw weakness in U.S. stocks but said the dollar would also crash and hyperinflation would immediately ensue.

Only ONE analyst, that we know of, made the following forecasts:

- Real estate, stocks and commodities would all top.

- A monumental credit crisis would reduce lending and borrowing around the world.

- The dollar would rally.

- Deflation would reign across almost all asset classes.

That analyst’s name is Robert Prechter.

Prechter – a man who’s made the arduous journey from fame to outcast and back – has scoured his complete writings on deflation and compiled the most important into a special 60-page Deflation Survival eBook.

Until today, most of the forecasts and advice in this still-prescient eBook have been released only to Prechter’s faithful subscribers. Now the 60-page Deflation Survival eBook can be yours for free.

Learn more about this unique opportunity by following the link below.

Complimentary eBook: Download the full 60-page Deflation Survival eBook now

Part 2 of Elliott Wave International’s expansive NEW Deflation Survival eBook is online now. The free 60-page eBook is packed with Robert Prechter's most important teachings and warnings about deflation. This is one of the most valuable resources EWI has ever offered at no cost. Learn more below or download it now – for free.

……………

Greetings,

We contacted you earlier this week to tell you about an exciting, free 60-page eBook our friends at Elliott Wave International have just put together.

The new eBook is compiled from Bob Prechter’s most important teachings and warnings about deflation.

Much like Prechter’s wildly popular Independent Investor eBook, this new Deflation Survival eBook will transform the way you think – about inflation and deflation.

Most financial experts were caught completely of guard by the real estate top in 2005. Many thought the Dow Industrials index would sour well beyond its 14,000 peak. Others saw weakness in U.S. stocks but said the dollar would also crash and hyperinflation would immediately ensue.

Only ONE analyst, that we know of, made the following forecasts:

- Real estate, stocks and commodities would all top.

- A monumental credit crisis would reduce lending and borrowing around the world.

- The dollar would rally.

- Deflation would reign across almost all asset classes.

That analyst’s name is Robert Prechter.

Prechter – a man who’s made the arduous journey from fame to outcast and back – has scoured his complete writings on deflation and compiled the most important into a special 60-page Deflation Survival eBook.

Until today, most of the forecasts and advice in this still-prescient eBook have been released only to Prechter’s faithful subscribers. Now the 60-page Deflation Survival eBook can be yours for free.

Learn more about this unique opportunity by following the link below.